.

Who We Serve

.

Retirement should be a time of excitement, not anxiety. Let’s embark on this journey together, ensuring that you can enjoy the retirement you deserve. Partner with us today to take the first step towards a confident retirement.

.

Elevate your financial future by harnessing the power of your practice. Experience the difference of personalized financial planning tailored specifically to the needs of practice owners.

.

Transform your self-employment venture into a powerhouse for personal wealth growth. With my specialized expertise in serving self-employed individuals, I’ll craft a strategic financial roadmap that maximizes profits, minimizes tax burdens, and propels you toward unparalleled financial security.

.

Randall Avery, CFP®, CFA

Randall Avery, CFP®, CFA is a trusted, Fee-Only, CERTIFIED FINANCIAL PLANNER™. Allow me to be your guide to financial freedom! With over 15 years of experience helping people with money, I understand the unique needs of pre-retirees, self-employed individuals, and practice owners like you.

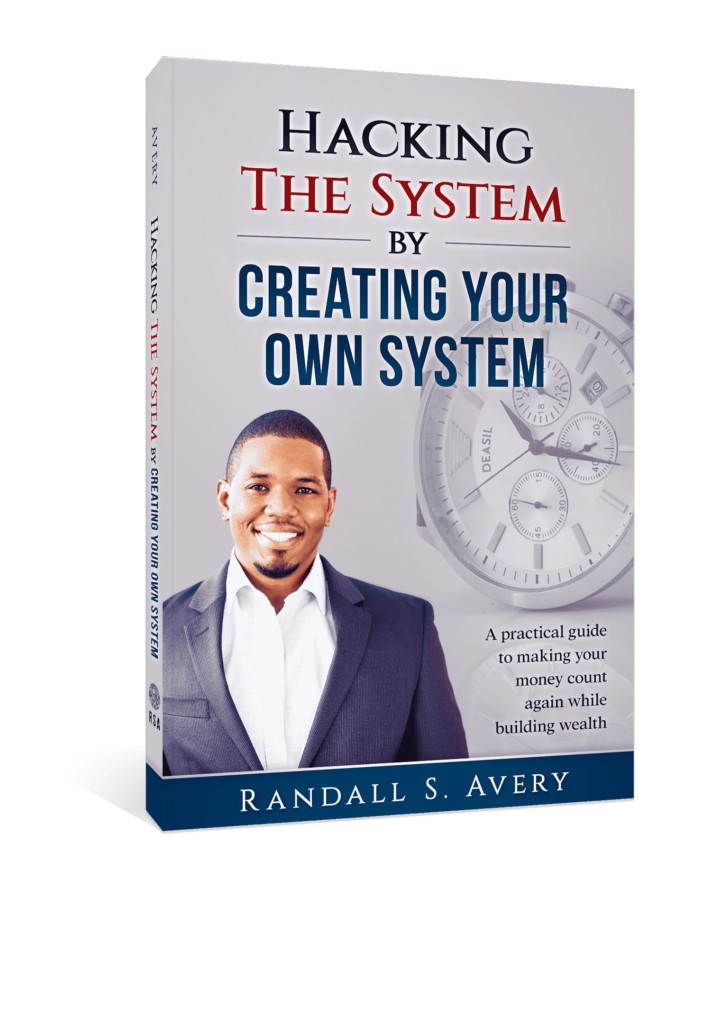

Hacking The System

Discover a whole new path to financial empowerment with my latest book, “Hacking the System by Creating Your Own System,” available now on Amazon. This exceptional self-help guide is tailored for those seeking an alternative to traditional financial planning books. Take the reins of your financial destiny and unlock the secrets to mastering your finances with ease and confidence. Don’t miss the opportunity to embark on this life-changing journey toward financial literacy and control. Grab your copy today!

FAQ

A1: As a fee-only certified financial planner, I am compensated solely by the fees paid by my clients. I don’t earn commissions or sell financial products, ensuring that my advice is unbiased and always in your best interest.

A2: Virtual financial planning allows us to connect seamlessly through video calls, emails, and secure online platforms. I leverage cutting-edge technology to ensure secure communication and efficient collaboration, making it convenient for you to access financial advice from anywhere.

A3: As a fiduciary, I am legally obligated to act in your best interest. This means I prioritize your financial well-being above all else, providing transparent and objective advice to help you achieve your goals.

A4: I offer a comprehensive range of services, including cash flow management, financial planning, and portfolio management. These services work together to create a holistic financial strategy tailored to your unique circumstances, ensuring that every aspect of your financial life is optimized.

A5: My fees are transparent and based on the complexity of your financial situation. During our initial consultation, I will provide a detailed breakdown of the fees associated with the specific services you require.

A6: Cash flow management is crucial for financial success. I work with you to analyze your income, expenses, and financial goals, creating a customized plan to optimize your cash flow, build savings, and achieve your objectives.

A7: The financial planning process is comprehensive, covering areas such as budgeting, retirement planning, tax strategies, and estate planning. We work collaboratively to understand your goals and create a roadmap to guide you toward financial success.

A8: My investment philosophy is grounded in a disciplined and diversified approach. As a holder of the Chartered Financial Analyst designation, I leverage my expertise to construct and manage portfolios tailored to your risk tolerance, financial goals, and the prevailing market conditions.

A9: Regular reviews are essential to ensure your financial plan remains aligned with your goals. We typically conduct reviews annually, but adjustments can be made more frequently if there are significant life changes or market shifts.

A10: It’s easy! Simply reach out through my website or give me a call to schedule a virtual consultation. We’ll discuss your financial objectives and determine how I can best support you in achieving them.